Gift Planning

Gift Planning

Gift Planning Menu

Gift Planning Menu

Part gift and part sale

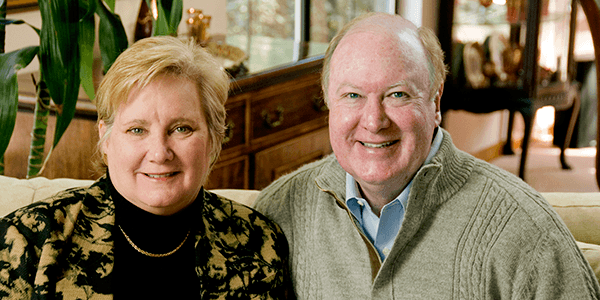

Lifelong Memphians, Elizabeth and Walter also wanted to support a community organization that they believed in. They identified a nonprofit that could make use of the building and worked out a plan that would benefit them both. The nonprofit paid 40% of the fair market value of the property; the rest was a gift from Elizabeth and Walter. The nonprofit was able to get a far more impressive and sizable space than it would have been able to afford otherwise. Elizabeth and Walter recouped some of their real estate investment and avoided significant capital gains taxes.

You may also have an asset that could allow you to leave a meaningful legacy through a part gift and part sale to a nonprofit organization. You receive not only some income from the sale, but also a tax benefit and a special way to support your community. Email Director of Development Caroline Kuebler or call her at (901) 722-0036 to learn more.